EU Tax Rules

If you are from an EU country, running international events and want to charge your registrants tax follows EU VAT Rules, follow the instructions below to configure Events Booking to make it compatible with the rules

- Go to Events Booking -> Custom Fields, create a Text custom field to allow registrants to enter their VAT Number.

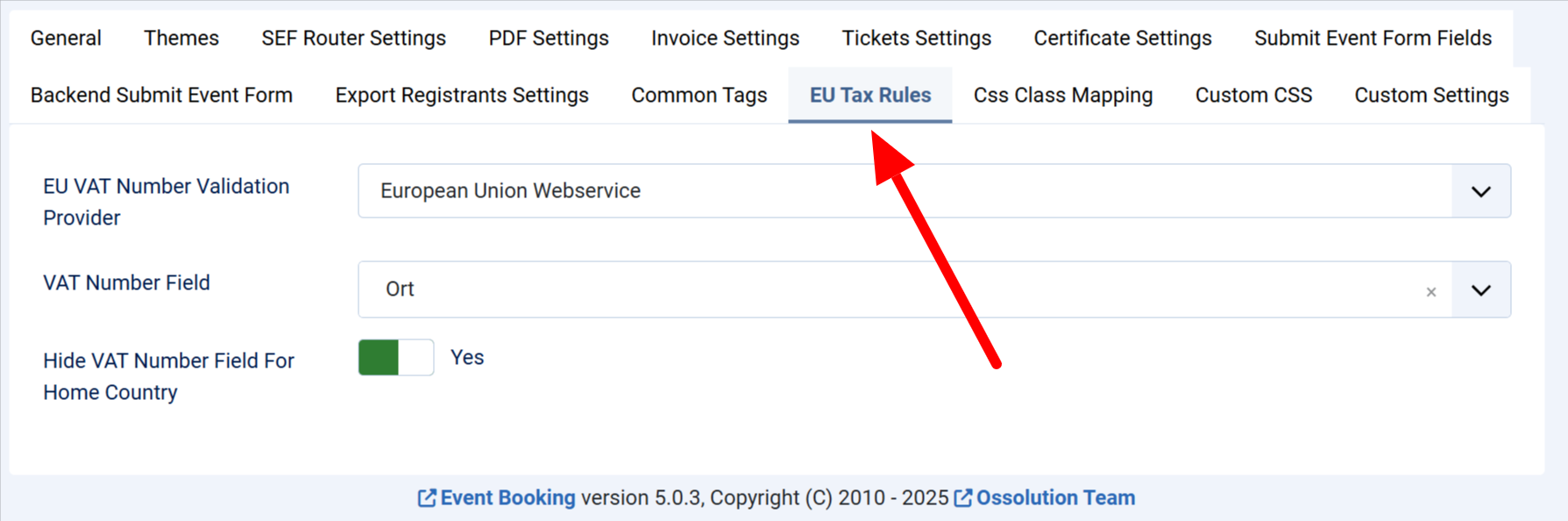

- Go to Events Booking -> Configuration, look at EU Tax Rules tab:

- Set Default Country config option to your country (must be an EU country)

- Set EU VAT Number Validation Provider config option to the provider you want. Suggest to use vatcomply.com API as it is more reliable.

- Set VAT Number config option to the custom field which you created above.

- Set Hide VAT Number Field For Home Country config option to Yes. Registrants from home country will be charged tax anyway, so it does not make sense to ask them to enter VAT Number

- Access to this URL to have necessary tax rules created (replace https://domain.com/administrator with administrator URL of your site) https://domain.com/administrator/index.php?option=com_eventbooking&task=tool.build_eu_tax_rules

Now, when someone registers for your events, they will be charged tax follow EU Tax Rules:

-

Registrants from none EU countries won't be charged tax

-

Registrants from home country (your own country) will always being charged tax rate base on your country tax rate

-

For registrants from other EU countries:

-

If they have a valid VAT Number, they won't be charged tax

-

If they do not have a valid VAT Number, they will be charged the tax rate of their own country